- UNI recorded gains of 11.4% in the last seven days.

- Uniswap increased its efforts to roll out next version V4.

Native token of leading decentralized exchange (DEX) Uniswap [UNI] clocked double-digit gains over the week, sparking curiosity among market observers.

UNI sees increasing demand as..

As of this writing, the $4 billion-DeFi token was exchanging hands at $6.73, representing gains of 11.4% in the last seven days, according to CoinMarketCap.

While there was no direct link to suggest, the anticipation over upcoming Uniswap v4 could have sparked positive sentiment among investors.

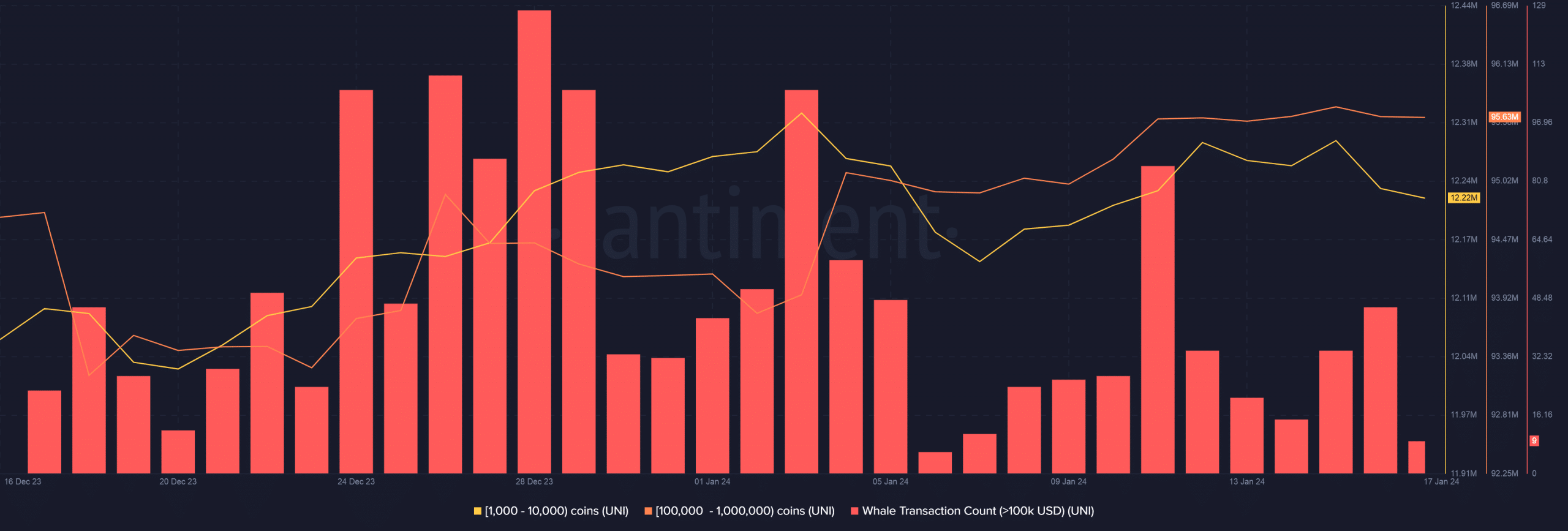

Indeed, large transactions worth at least $100K witnessed noticeable spikes in the last 10 days.

Frantic buying on the 11th of January resulted in a sharp increase in the holdings of popular whale user cohorts, AMBCrypto noticed using Santiment data.

Source: Santiment

All eyes on V4

For the curious, the latest version V4 advances things further by introducing the idea of customizable liquidity through the usage of “hooks”.

As per Uniswap, hooks are plugins which will enable users to create custom liquidity pools to control how pools, swaps, fees interact with each other.

Since then, the team has increased its efforts and, according to a recent update, has set aside $300,000 for the development of its V4 front-end.

The team wanted to build a solution that would support Uniswap V2’s current use cases. This is because, ironically, V2 is more successful than the latest iteration V3.

As of this writing, Uniswap was the largest DEX in terms of daily volumes, as per AMBCrypto’s examination of DeFiLlama data.

More than $1.2 billion worth of trades were settled on the platform in the last 24 hours, dwarfing the volumes of even the second-ranked Pancakeswap [CAKE].

2024 starts on a good note

Source: DeFiLlama